Heat Pump Tax Credit 2025 Michigan: Complete Guide to Federal Incentives

Michigan homeowners have a limited window to save thousands on energy-efficient heating and cooling upgrades. The federal heat pump tax credit offers up to $2,000 in savings for qualifying installations, but this opportunity expires on December 31, 2025. With Michigan’s harsh winters and rising energy bills, heat pumps represent a smart investment that can dramatically reduce your carbon footprint while providing year-round home comfort.

This comprehensive guide will help Michigan homeowners understand how to maximize these federal tax credits before they disappear. You’ll learn about eligible equipment, filing requirements, and additional state incentives that can further reduce your upfront costs. Whether you’re replacing an aging furnace or upgrading your entire HVAC system, understanding these incentives can save you significant money on your energy-efficient home improvement project.

2025 Heat Pump Tax Credit Overview for Michigan Homeowners

The federal government provides substantial financial incentives for Michigan homeowners who invest in energy-efficient heating and cooling systems. The Energy Efficient Home Improvement Credit, established under Section 25C of the tax code and enhanced by the Inflation Reduction Act, offers a 30% tax credit on qualifying heat pump installations, including both equipment and installation costs.

For 2025, this credit maxes out at $2,000 annually for heat pump systems, making it one of the most valuable energy tax credits available to homeowners. Unlike a tax deduction that reduces your taxable income, this credit directly reduces your tax liability dollar-for-dollar. If you owe $3,000 in federal taxes and qualify for the full $2,000 credit, your tax bill drops to just $1,000.

The credit applies to your principal residence only – vacation homes and rental properties don’t qualify. However, both homeowners and renters can claim the credit if they’re responsible for the improvement costs. The system must be placed in service during the tax year to claim the credit, meaning installation date, not purchase date, determines eligibility.

Recent legislative changes have accelerated the credit’s expiration timeline. While the original Inflation Reduction Act extended these incentives through 2032, the One Big Beautiful Bill Act of 2025 moved the deadline to December 31, 2025. This creates urgency for Michigan homeowners considering HVAC upgrades, as missing this deadline means losing access to thousands in potential savings. Purchasing a new HVAC system can qualify you for these financial benefits and incentives, including valuable tax credits and rebates for upgrading to a more energy-efficient solution.

The credit is non-refundable, meaning it can reduce your federal tax liability to zero but won’t generate a refund if the credit exceeds what you owe. Additionally, unused credits cannot be carried forward to future tax years, making it essential to verify eligibility and plan your taxes accordingly with a qualified tax professional.

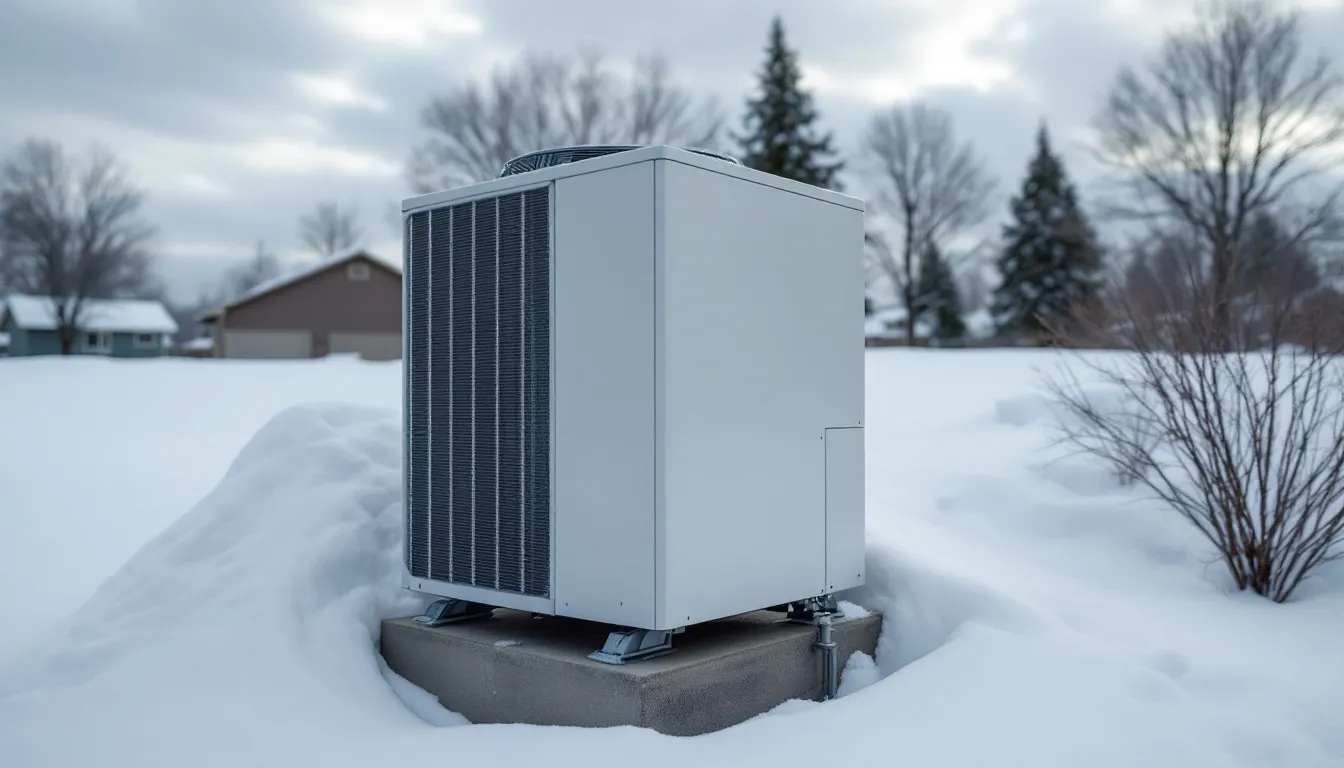

Why Heat Pumps Make Sense in Michigan’s Climate

Michigan’s temperature extremes make efficient heating and cooling systems essential for managing energy bills and maintaining comfortable homes year-round. Traditional heating methods like natural gas furnaces or electric resistance heating become increasingly expensive as energy costs rise, while aging air conditioners struggle with hot, humid summers.

Modern heat pumps address these challenges by providing both heating and cooling in a single, highly efficient system. Unlike furnaces that generate heat through combustion, heat pumps transfer existing heat from outside air or ground sources, making them significantly more energy-efficient. Even in Michigan’s frigid winters, advanced cold-climate heat pumps can extract heat from outdoor air and move it inside your home. In addition to heating and cooling, many modern heat pump systems also improve home ventilation, which helps enhance indoor air quality and contributes to overall energy efficiency.

The technology has evolved dramatically over the past decade. Today’s cold-climate air source heat pumps maintain efficiency ratings even when outdoor temperatures drop below zero degrees Fahrenheit. This makes them practical replacements for traditional heating systems throughout Michigan, from the Upper Peninsula’s harsh conditions to southeastern Michigan’s more moderate climate.

Heat pumps can reduce heating electricity use by up to 75% compared to electric resistance heating like baseboard heaters or electric furnaces. For homes currently using propane or heating oil, the savings can be even more substantial. The dual functionality means homeowners can replace both their furnace and air conditioning units with a single system, reducing maintenance costs and equipment complexity.

The environmental benefits align with Michigan’s growing focus on renewable energy and carbon reduction. Heat pumps produce significantly lower emissions than fossil fuel heating systems, especially when powered by electricity from renewable sources. As Michigan’s electric grid becomes cleaner through increased solar and wind generation, heat pumps become an even more sustainable choice for home heating and cooling.

Types of Heat Pumps Eligible for Tax Credits

Several heat pump technologies qualify for the federal tax credit, each offering unique advantages for Michigan homeowners. Understanding the differences helps you choose the right system for your home’s specific needs and maximize your energy savings.

Air-source heat pumps represent the most popular and cost-effective option for most Michigan homes. These systems extract heat from outdoor air using refrigeration technology, even in cold weather. To qualify for tax credits, air-source heat pumps must meet ENERGY STAR Most Efficient criteria or carry the ENERGY STAR Cold Climate label, which is particularly relevant for Michigan’s heating-dominated climate.

Central air-source heat pumps work with existing ductwork to distribute conditioned air throughout your home. They’re ideal for replacing traditional furnace and air conditioning combinations. Ductless mini-split systems offer zoned heating and cooling without requiring extensive ductwork modifications, making them perfect for additions, renovations, or homes with unique layouts.

Geothermal heat pumps, also called ground-source heat pumps, tap into the earth’s stable underground temperatures for exceptional efficiency. While installation costs are higher due to ground loop requirements, geothermal systems typically achieve the highest efficiency ratings and longest lifespans. They qualify for the same $2,000 annual credit limit but often provide superior long-term value in Michigan’s climate.

Heat pump water heaters also qualify under the same $2,000 annual limit, though they cannot be combined with space heating heat pumps to exceed this cap. These units can reduce water heating energy use by up to 70% compared to conventional electric water heaters, making them an excellent complement to whole-home heat pump systems.

All qualifying equipment must be new and meet specific efficiency requirements. The equipment must be installed in your primary residence by a qualified contractor who can provide proper documentation for tax filing purposes. Used or refurbished equipment doesn’t qualify, nor do systems installed in vacation homes or rental properties.

How Michigan Heat Pump Tax Credits Work

The mechanics of claiming heat pump tax credits are straightforward, but understanding the details ensures you maximize your savings and avoid common filing mistakes. The credit equals 30% of your total project cost, including both equipment and professional installation expenses, up to the $2,000 annual maximum.

Let’s examine practical examples for Michigan homeowners. If you install an air-source heat pump system costing $8,000 total, your credit would be $2,400 (30% of $8,000). However, the annual cap limits your actual credit to $2,000. For a more expensive $15,000 geothermal system, the calculation would be $4,500 (30% of $15,000), but again, the $2,000 maximum applies.

The credit can be combined with other energy-efficient home improvements under the same program. If you install qualifying insulation, windows, or doors in the same tax year, those improvements qualify for an additional 30% credit up to $1,200 annually. This means you could potentially claim $3,200 in total credits ($2,000 for heat pumps plus $1,200 for other improvements) in a single tax year.

Since this is a non-refundable credit, it can only reduce your federal tax liability to zero. If you owe $1,500 in federal taxes but qualify for the full $2,000 credit, you’ll eliminate your tax bill entirely, but you won’t receive the remaining $500 as a refund. This makes tax planning crucial – consult with a tax professional to optimize your situation.

Equipment Requirements and Qualifications

Heat pump systems must meet stringent efficiency standards to qualify for federal tax credits. For air-source heat pumps, the equipment must achieve ENERGY STAR Most Efficient certification or carry the ENERGY STAR Cold Climate label. These designations ensure the systems deliver superior performance in Michigan’s climate conditions.

Installation must occur in your principal residence – the home where you live most of the year. Second homes, vacation properties, and rental units don’t qualify for residential clean energy credit programs. The equipment must be new, not used or refurbished, and installed by a qualified professional who can provide proper certification and documentation.

Professional installation is required, not just recommended. DIY installations don’t qualify for tax credits, even if you purchase qualifying equipment. Your contractor should provide detailed receipts showing equipment costs, installation labor, and certification that the system meets efficiency requirements. Keep all documentation for tax filing and potential audit purposes.

The system must be placed in service during the tax year you claim the credit. This means the installation must be completed and the system operational, not just purchased or partially installed. If you buy equipment in December 2025 but installation isn’t completed until 2026, you cannot claim the credit since the program expires December 31, 2025.

Energy Audits and Assessments: Maximizing Your Eligibility

A professional home energy audit is one of the smartest first steps Michigan homeowners can take to unlock the full potential of energy tax credits and rebates. An energy audit is a comprehensive assessment of your home’s energy efficiency, pinpointing where energy is being lost and identifying the most effective energy-efficient home improvements. By having a certified energy auditor evaluate your home, you’ll receive a detailed report highlighting areas for upgrades—such as insulation, air sealing, windows, and doors—that can help you qualify for valuable tax credits like the 25C tax credit.

The 25C tax credit, enhanced by the Inflation Reduction Act, offers up to $1,200 in annual tax credits for eligible energy-efficient upgrades. Energy audits not only help you verify which improvements qualify, but also ensure you’re prioritizing upgrades that will save you the most money on your energy bills. By reducing wasted energy, you’ll see immediate savings, and you’ll be able to claim credits and rebates for the improvements you make.

Many Michigan utility companies, including DTE Energy and Consumers Energy, now offer free or low-cost energy audits to their customers, making it easier than ever to take advantage of these services. The Inflation Reduction Act has further expanded access to energy audits, recognizing their importance in helping homeowners save money and improve energy efficiency. By scheduling an audit, you’ll gain a clear roadmap for eligible upgrades, maximize your eligibility for tax credits and rebates, and make informed decisions that stretch your energy dollars further.

Taking advantage of an energy audit is a strategic move for any homeowner looking to save money, reduce energy bills, and ensure every eligible upgrade is counted toward your tax credit and rebate totals. With the right information in hand, you can confidently invest in energy-efficient home improvements that deliver both immediate and long-term financial benefits.

HVAC System Upgrades and Integration with Heat Pumps

Upgrading your HVAC system is a powerful way to boost your home’s energy efficiency, lower your energy bills, and maximize your eligibility for federal tax credits. Heat pumps, in particular, offer Michigan homeowners a modern, efficient solution for both heating and cooling—often replacing outdated furnaces and air conditioners with a single, streamlined system. Thanks to the Residential Clean Energy Credit, you can claim a tax credit worth up to 30% of the total cost of a qualifying heat pump system, making this upgrade more affordable than ever.

When considering an HVAC system upgrade, it’s important to evaluate your home’s size, insulation levels, and specific heating and cooling needs. Integrating a heat pump with your existing HVAC system can be straightforward, but working with a knowledgeable contractor ensures you select the right system for your home and climate. Properly sized and installed heat pumps deliver maximum efficiency, comfort, and savings.

Don’t overlook the value of consulting a tax professional during this process. Navigating the details of tax credits, rebates, and eligibility requirements can be complex, and a tax professional can help you claim every available incentive. In addition to the federal tax credit, many Michigan utility companies offer rebate programs for HVAC system upgrades, further reducing your upfront costs and making the transition to a new, efficient system even more affordable.

By upgrading your HVAC system and integrating a heat pump, you’ll not only reduce your energy consumption and monthly bills, but also take full advantage of tax credits, rebates, and other incentives. These investments pay off in lower costs, improved home comfort, and a smaller carbon footprint—making now the ideal time to make your home’s heating and cooling system as efficient as possible.

Credit Expiration and Urgency for Michigan Homeowners

Time is running short for Michigan homeowners to take advantage of these substantial federal incentives. The original Inflation Reduction Act provided a comfortable timeline, extending credits through 2032. However, the One Big Beautiful Bill Act of 2025 dramatically shortened this window, creating an urgent deadline of December 31, 2025.

This accelerated timeline means Michigan homeowners have less than a year to complete heat pump installations and claim federal tax credits. The implications extend beyond individual savings – the approaching deadline is already affecting contractor availability and scheduling throughout the state.

HVAC contractors across Michigan report increased demand as homeowners rush to complete projects before the credit expires. This surge in demand may lead to longer wait times for installations, higher labor costs, and potential equipment shortages for the most popular models. Starting your project planning immediately gives you the best chance of completing installation before the deadline.

To get started, schedule a free consultation with a qualified HVAC contractor. A free consultation allows you to assess your eligibility, discuss your options, and begin the process with no upfront cost.

The deadline is firm – there are no extensions or grace periods for projects started but not completed by December 31, 2025. Even if you sign a contract in early December, the installation must be finished and the system operational by year-end to qualify. Partial installations or systems not yet placed in service won’t qualify for credits.

Consider the practical timeline for heat pump installations. Quality contractors typically need 2-4 weeks from initial consultation to completed installation, depending on system complexity and permitting requirements. Factor in potential delays for permits, equipment delivery, and weather-related installation challenges common in Michigan winters.

Additional Michigan Energy Incentives

While federal tax credits provide the largest savings opportunity, Michigan homeowners can often combine these incentives with state and local programs for even greater cost reductions. The state’s major utilities, DTE Energy and Consumers Energy, offer rebate programs specifically designed to encourage energy-efficient upgrades.

DTE Energy provides rebates for qualifying heat pump installations, typically ranging from $300 to $1,000 depending on system efficiency and type. Their programs often include free home energy audits to help homeowners identify the most cost-effective improvements. Consumers Energy offers similar rebate programs, with additional incentives for customers who participate in their energy efficiency programs.

Michigan Saves, a nonprofit green bank, provides low-interest financing for energy improvements, including heat pump installations. Their loans can help homeowners manage upfront costs even after applying federal tax credits and utility rebates. Interest rates are typically below market rates, and the financing can cover both equipment and installation costs.

Local municipalities occasionally offer additional incentives for energy-efficient upgrades. Some Michigan cities and counties provide property tax exemptions or additional rebates for renewable energy and efficiency improvements. Contact your local government to inquire about available programs in your area.

The combination of federal tax credits, utility rebates, and favorable financing can dramatically reduce the net cost of heat pump installations. For example, a $10,000 heat pump project might qualify for a $2,000 federal credit, $500 utility rebate, and low-interest financing for the remaining balance, making monthly payments potentially lower than current energy bill savings.

Cost Savings and Return on Investment

Understanding the financial impact of heat pump installations helps Michigan homeowners make informed decisions about their HVAC investments. Typical air-source heat pump installations cost between $8,000 and $15,000, depending on system size, efficiency rating, and installation complexity. Geothermal systems generally range from $15,000 to $25,000 due to ground loop installation requirements.

The $2,000 federal tax credit significantly reduces these upfront costs, effectively lowering a $10,000 installation to $8,000 out-of-pocket after credits. When combined with utility rebates and other incentives, net costs drop even further, often making heat pumps competitive with traditional HVAC replacements.

Annual energy savings vary based on your current heating system and home efficiency, but Michigan homeowners typically save $800 to $1,500 annually when switching from electric resistance heating to heat pumps. Homes currently using propane or heating oil often see even larger savings, sometimes exceeding $2,000 annually.

Payback periods for heat pump investments typically range from 5 to 10 years, depending on current energy costs and system efficiency. However, heat pumps provide benefits beyond just energy savings. They improve home comfort through consistent temperatures, reduce maintenance requirements compared to separate heating and cooling systems, and often increase property values.

Consider a practical example: A Michigan homeowner replaces an aging furnace and air conditioning system with a $12,000 heat pump installation. After the $2,000 federal credit and $500 utility rebate, the net cost is $9,500. If the new system saves $1,200 annually in energy bills, the payback period is just under 8 years, with continued savings for the system’s 15-20 year lifespan.

The financial analysis becomes even more favorable when considering avoided replacement costs. If your current furnace or air conditioner requires replacement anyway, the incremental cost of upgrading to a heat pump system is often minimal compared to purchasing separate traditional equipment.

How to Claim Your Heat Pump Tax Credit

Filing for heat pump tax credits requires specific documentation and proper completion of IRS forms. The process is manageable for most homeowners, but understanding the requirements prevents costly mistakes and ensures you receive the full credit amount.

Use IRS Form 5695, “Residential Energy Credits,” to claim your heat pump tax credit. This form calculates your total eligible credits and transfers the amount to your main tax return. The form requires detailed information about your equipment, installation costs, and certification that systems meet efficiency requirements.

Documentation is crucial for successful credit claims. Keep all receipts showing equipment and installation costs, manufacturer certification statements proving equipment meets efficiency standards, and contractor documentation confirming professional installation. The IRS may request this information during audits, so maintain organized records for at least three years after filing.

Your contractor should provide a Manufacturer’s Certification Statement (MCS) confirming that installed equipment meets ENERGY STAR requirements. This document is essential for claiming credits and should specify the exact model numbers and efficiency ratings of installed equipment. Verify this information before final payment to your contractor.

Calculate your credit carefully using the form instructions. List all qualifying equipment and installation costs, multiply by 30%, then apply the $2,000 annual maximum for heat pumps. If you’re also claiming credits for other improvements like insulation or windows, use the separate $1,200 annual limit for those items.

Consult with a qualified tax professional, especially if you’re claiming multiple energy credits or have complex tax situations. Professional assistance ensures proper filing, maximizes your available credits, and provides peace of mind that you’re complying with all IRS requirements. The cost of professional tax preparation often pays for itself through avoided errors and optimized credit claims.

File your tax return by the standard deadline to claim credits for installations completed in the previous year. Extensions for filing don’t extend the credit program deadline – equipment must still be installed by December 31, 2025, to qualify. However, you have until your filing deadline to submit the required forms and claim your credits.

Next Steps for Michigan Homeowners

Taking action quickly is essential for Michigan homeowners who want to benefit from federal heat pump tax credits before they expire. The approaching December 31, 2025 deadline means starting your project planning immediately gives you the best chance of completing installation in time.

Begin by contacting qualified HVAC contractors for assessments and quotes. Look for contractors experienced with heat pump installations who understand the tax credit requirements and can provide proper documentation. Request quotes from multiple contractors to compare pricing, equipment options, and installation timelines.

During contractor consultations, discuss your home’s specific heating and cooling needs, existing ductwork condition, and electrical system capacity. Ask about different heat pump technologies and which options work best in Michigan’s climate. Ensure contractors can provide equipment that meets ENERGY STAR efficiency requirements for tax credit eligibility.

Research additional state and utility incentives available in your area. Contact DTE Energy or Consumers Energy to learn about current rebate programs and application requirements. Investigate Michigan Saves financing options if you need help managing upfront costs even after applying tax credits and rebates.

Consider scheduling a professional home energy audit to identify other efficiency improvements that might qualify for the additional $1,200 annual credit. Combining insulation, air sealing, or window upgrades with heat pump installation can maximize your total tax credit benefits in a single year.

Plan your project timeline carefully, allowing extra time for potential delays. Michigan winters can complicate installation schedules, and increasing demand as the deadline approaches may extend typical project timelines. Starting early gives you flexibility to address unexpected challenges without missing the credit deadline.

Don’t wait until late 2025 to begin planning. Quality contractors are already booking installations months in advance, and the best equipment options may become scarce as demand increases. Taking immediate action ensures you can secure qualified contractors, preferred equipment choices, and reasonable pricing before market pressures intensify.

The opportunity to save thousands on energy-efficient home upgrades won’t last beyond 2025. Start planning your heat pump installation today to take advantage of these substantial federal incentives while they’re still available. Your future energy bills – and home comfort – will thank you for making this smart investment before time runs out.